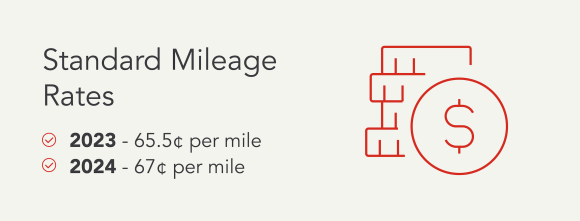

Business Miles Tax Deduction 2024 – Claiming 100% business use of a vehicle is a risky move So if you keep a mileage log, you may be able to deduct the cost of mileage on your taxes. The standard rate is $0.655 per mile for 2023, . In the past, taxpayers had more options to deduct mileage and could claim unreimbursed travel while on the job. “That’s not deductible anymore,” says Michelle Brown, managing director in the Kansas .

Business Miles Tax Deduction 2024

Source : timeero.comSelf Employed Worker Mileage Deduction Guide (2024 Update)

Source : triplogmileage.comSelf Employed Tax Deductions Calculator 2023 2024 Intuit

Source : blog.turbotax.intuit.comIRS Announces Increased Business Mileage Rate for 2024

Source : www.driversnote.comFree Mileage Log Template for Delivery Drivers Driversnote

Source : www.driversnote.comThe Best Business Mileage Tracker Apps for 2024

Source : www.fylehq.comBusiness mileage tax deduction rate goes up, medical and moving

Source : www.dontmesswithtaxes.comHow To Claim Mileage on Taxes in Five Easy Steps

Source : www.driversnote.comIRS Mileage Rate for 2023 2024 | Moneywise

Source : moneywise.com25 Small Business Tax Deductions (2024)

Source : www.freshbooks.comBusiness Miles Tax Deduction 2024 Timeero IRS Mileage Rate for 2024: What Can Businesses Expect : but a few self-employment tax deductions might help you recoup some of that wear and tear. What you can deduct: A little more than $1 for every two miles you put on your car for business purposes. . Taxpayers can take advantage of numerous tax deductions, also known as tax write-offs, to lower their tax bill or receive a refund from the IRS come tax season. Learn More: Trump-Era Tax .

]]>